As the descending broadening wedge pattern is forming trading volumes become most meaningful as the pattern breaks out above the upper trend line, this should happen on increasing volume showing that the chart is starting to go into an accumulation cycle. Again, this means that you can look for potential buying opportunities. It indicates the resumption of the uptrend. This pattern looks like a megaphone pointing down and to the right.Ī descending broadening wedge is looked at as a bullish pattern as it forms but it is not validated as a buy signal until the pattern starts to make short term higher lows and higher highs and the upper resistance trend line is broken and price begins to move to the upside and above the upper trend line. A falling wedge found in an uptrend is considered a continuation pattern that occurs as the market contracts temporarily. The falling broadening wedge can be bullish, bearish or neutral, depending on. The only difference is that it slopes downwards as the price moves lower. A falling wedge is formed by two converging trend lines when the stocks prices have been falling for a certain period. This pattern is similar to any other symmetrical broadening wedges. The upper line is the resistance line the lower line is the. At the moment the price is overbought when looking at the RSI.

The trade can be entered once the price breaks out of the pattern to the upside. A descending broadening wedge is a bullish reversal pattern. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. On the Dash chart, a descending broadening wedge has appeared (1h-timeframe).

#Trading descending wedge how to#

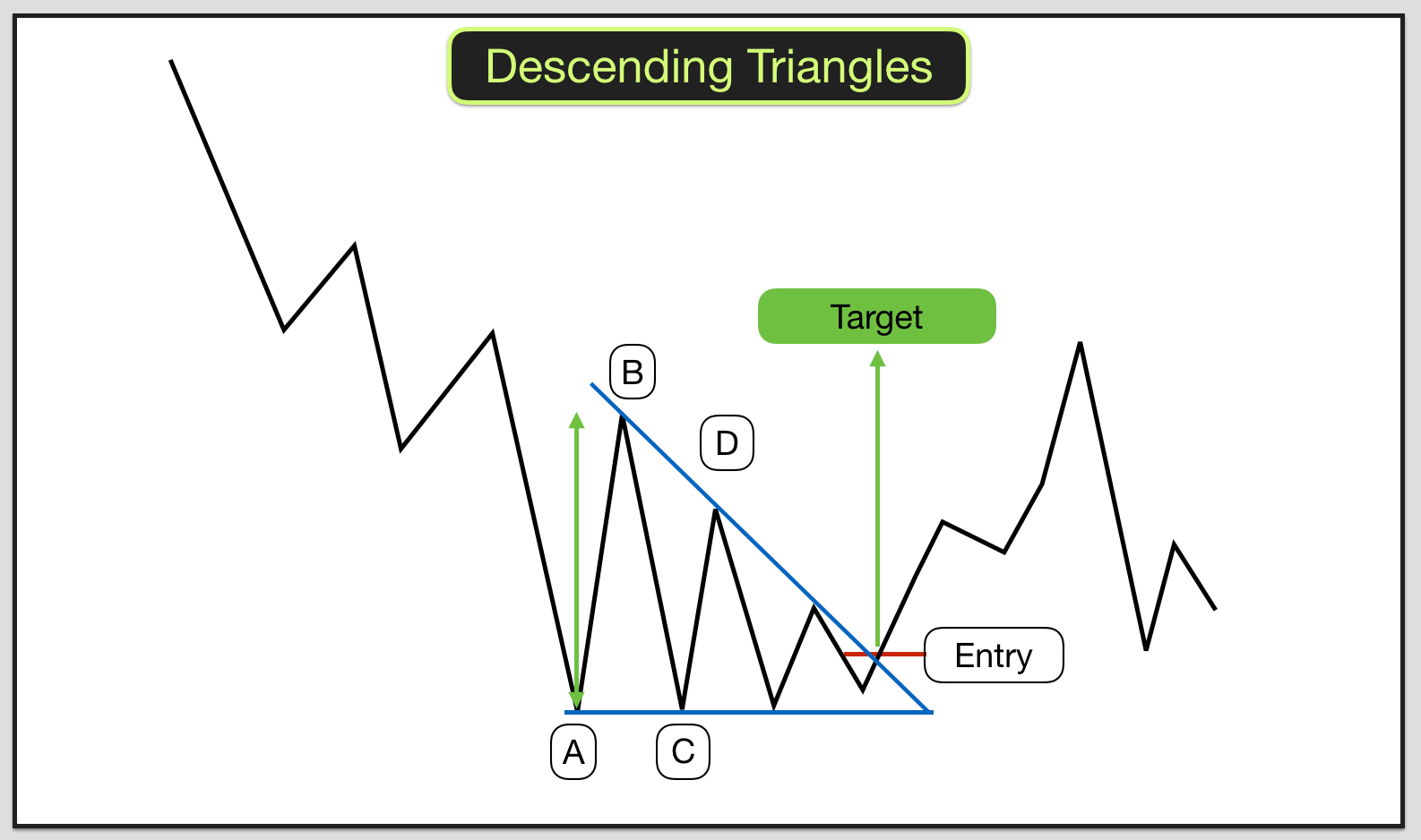

It is formed by two diverging bullish lines. How to Trade the descending Broadening Wedge Enter the market by placing a buy order (long entry) on the break of the top side of the wedge. An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern).

#Trading descending wedge series#

Price should touch each line 2 or 3 times to be considered a valid pattern. The broadening descending wedge pattern is formed by two diverging lines that connect a series of lower highs and lower lows. UnknownUnicorn3442968 Updated Nov 30, 2019. Ī descending broadening wedge forms as price moves between the upper resistance and lower support trend lines multiple times as the trading range expands during the downtrend in price. The descending broadening wedge pattern can extend for long periods on rising volatility.

Traders should look for rising wedge patterns and falling wedge. This pattern is created by two declining and diverging trend lines. Descending Wedge Chart Patterns Chart Patterns Trading, Stock Chart Patterns, Trading Charts. A descending broadening wedge chart pattern is a bullish reversal pattern.

0 kommentar(er)

0 kommentar(er)